Reminder! Employers can deduct $5,250 of payments towards employees' student loans!

Read More

8 Strategies to Consider: Year-End Tax Planning For Your Business

Read More

If you filed for an extension, the deadline is coming up!

Read More

Beware! Self-Employment Tax Credit Scam

Read More

5 Newly Announced Signs of an Incorrect ERC Claim

Read More

9 Common Business Tax Deductions

Read More

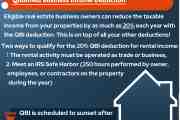

Qualified Business Income Deduction

Read More

2024 “BENEFICIAL OWNERSHIP INFORMATION” REPORTING REQUIREMENTS

Read More