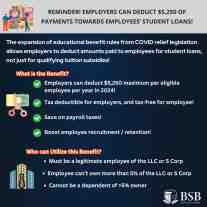

Reminder! Employers can deduct $5,250 of payments towards employees' student loans!

The expansion of educational benefit rules from COVID relief legislation allows employers to deduct amounts paid to employees for student loans, not just for qualifying tuition subsidies!

What is the Benefit?

Who can Utilize this Benefit?

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.