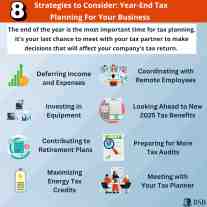

8 Strategies to Consider: Year-End Tax Planning For Your Business

The end of the year is the most important time for tax planning. It's your last chance to meet with your tax partner to make decisions that will affect your company's tax return.

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.