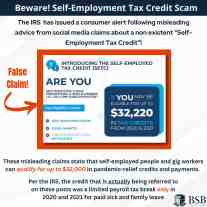

Beware! Self-Employment Tax Credit Scam

The IRS has issued a consumer alert following misleading advice from social media claims about a nonexistent “Self-Employment Tax Credit”!

These misleading claims state that self-employed people and gig workers can qualify for up to $32,000 in pandemic-relief credits and payments.

Per the IRS, the credit that is actually being referred to on these posts was a limited payroll tax break only in 2020 and 2021 for paid sick and family leave

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.