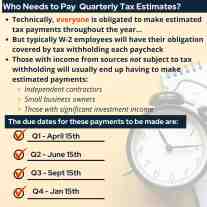

Who Needs to Pay Quarterly Tax Estimates?

The due dates for these payments to be made are:

Q1 - April 15th

Q2 - June 15th

Q3 - Sept 15th

Q4 - Jan 15th

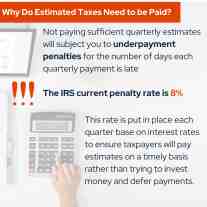

Why Do Estimated Taxes Need to be Paid?

Not paying sufficient quarterly estimates will subject you to underpayment penalties for the number of days each quarterly payment is late

The IRS current penalty rate is 8%

This rate is put in place each quarter base on interest rates to ensure taxpayers will pay estimates on a timely basis rather than trying to invest money and defer payments.

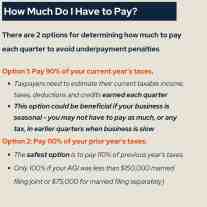

How Much Do I Have to Pay?

There are 2 options for determining how much to pay each quarter to avoid underpayment penalties

Option 1: Pay 90% of your current year’s taxes.

Option 2: Pay 110% of your prior year's taxes.

If you're a taxpayer in the New York Metro Area and need help making the best decisions for tax return, request a consultation with our experienced accountants today. We look forward to providing you service.