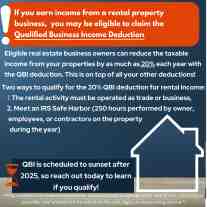

If you earn income from a rental property business, you may be eligible to claim the Qualified Business Income Deduction.

Eligible real estate business owners can reduce the taxable income from your properties by as much as 20% each year with the QBI deduction. This is on top of all your other deductions!

Two ways to qualify for the 20% QBI deduction for rental income:

QBI is scheduled to sunset after 2025, so reach out today to learn if you qualify!

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.