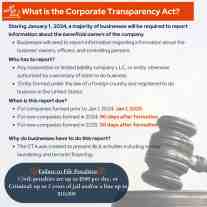

What is the Corporate Transparency Act?

Staring January 1, 2024, a majority of businesses will be required to report information about the beneficial owners of the company

- Businesses will need to report information regarding information about the business’ owners, officers, and controlling persons.

Who has to report?

- Any corporation or limited liability company LLC, or entity otherwise authorized by a secretary of state to do business

- Entity formed under the law of a foreign country and registered to do business in the United States.

When is this report due?

- For companies formed prior to Jan 1, 2024: Jan 1, 2025

- For new companies formed in 2024: 90 days after formation

- For new companies formed in 2025: 30 days after formation

Why do businesses have to do this report?

- The CTA was created to prevent illicit activities including money laundering and terrorist financing.

Failure to File Penalties:

Civil: penalties are up to $500 per day, or

Criminal: up to 2 years of jail and/or a fine up to $10,000

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.