Taxpayers Can Qualify for Home Energy Credits on Home Improvements

The Energy Efficient Home Improvement Credit & the Residential Clean Energy Credit can be claimed for the tax year the qualifying expenditures were made.

These credits apply to:

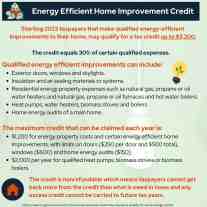

Energy Efficient Home Improvement Credit

Starting 2023 taxpayers that make qualified energy-efficient improvements to their home, may qualify for a tax credit up to $3,200.

The credit equals 30% of certain qualified expenses.

Qualified energy efficient improvements can include:

The maximum credit that can be claimed each year is:

The credit is nonrefundable which means taxpayers cannot get back more from the credit than what is owed in taxes and any excess credit cannot be carried to future tax years.

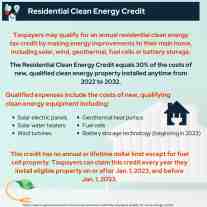

Residential Clean Energy Credit

Taxpayers may qualify for an annual residential clean energy tax credit by making energy improvements to their main home, including solar, wind, geothermal, fuel cells or battery storage.

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property installed anytime from 2022 to 2032.

Qualified expenses include the costs of new, qualifying clean energy equipment including:

This credit has no annual or lifetime dollar limit except for fuel cell property. Taxpayers can claim this credit every year they install eligible property on or after Jan. 1, 2023, and before Jan. 1, 2033.

If you're a taxpayer in the New York Metro Area and need help making the best decisions for tax return, request a consultation with our experienced accountants today. We look forward to providing you service.