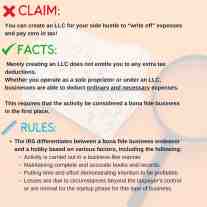

CLAIM:

You can create an LLC for your side hustle to “write off” expenses and pay zero in tax!

FACTS:

Merely creating an LLC does not entitle you to any extra tax deductions.

Whether you operate as a sole proprietor or under an LLC, businesses are able to deduct ordinary and necessary expenses.

This requires that the activity be considered a bona fide business in the first place.

RULES:

If you're a taxpayer in the New York Metro Area and need help making the best decisions for tax return, request a consultation with our experienced accountants today. We look forward to providing you service.