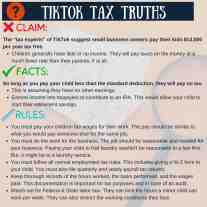

TikTok Tax Truths

CLAIM:

The “tax experts” of TikTok suggest small business owners pay their kids $13,000 per year tax free.

- Children generally have little or no income. They will pay taxes on the money at a much lower rate than their parents, if at all.

FACTS:

So long as you pay your child less than the standard deduction, they will pay no tax.

- This is assuming they have no other earnings.

- Earned income lets taxpayers to contribute to an IRA. This would allow your child to start their retirement savings.

RULES:

- You must pay your children fair wages for their work. The pay should be similar to what you would pay someone else for the same job.

- You must do the work for the business. The job should be reasonable and needed for your business. Paying your child to fold laundry wouldn't be reasonable to a law firm. But, it might be to a laundry service.

- You must follow all normal employment tax rules. This includes giving a W-2 form to your child. You must also file quarterly and yearly payroll tax returns.

- Keep thorough records of the hours worked, the tasks performed, and the wages paid. This documentation is important for tax purposes and in case of an audit.

- Watch out for Federal & State labor law. They can limit the hours a minor child can work per week. They can also restrict the working conditions they face.

If you're a taxpayer in the New York Metro Area and need help making the best decisions for tax return, request a consultation with our experienced accountants today. We look forward to providing you service.