There are three general categorizations of income from a tax perspective:

Income from one basket cannot be reduced by losses in a different basket.

For Real Estate Investors – this means you generally can't offset your active business income or wages with losses from your real estate.

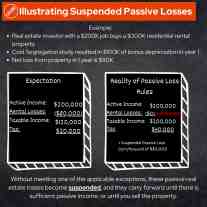

Illustrating Suspended Passive Losses

Example:

Without meeting one of the applicable exceptions, these passive real estate losses become suspended, and they carry forward until there is sufficient passive income, or until you sell the property.

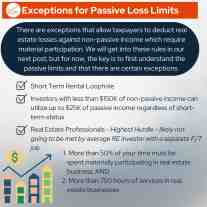

Exceptions for Passive Loss Limits

There are exceptions that allow taxpayers to deduct real estate losses against non-passive income which require material participation. We will get into these rules in our next post, but for now, the key is to first understand the passive limits and that there are certain exceptions.

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.