What is a Cost Segregation Study?

Cost Segregation Study is a tax planning strategy that gives real estate owners the chance to accelerate depreciation deductions. The best time to do a Cost Segregation Study is the first year the property is placed in service.

The Normal depreciation period for real property:

The goal of a Cost Segregation Study is to identify all property-related costs that can be accelerated and depreciated over 5,7 and 15 years.

Cost Seg Study Illustration: Breaking Down Components of a Building

A Commerical building with Cost Seg Study has several components with their own depreciation:

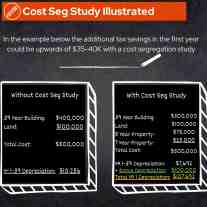

Cost Seg Study Illustrated

In the example, the additional tax savings in the first year could be upwards of $35-40K with a Cost Segregation Study.

Cost Segregation Study Benefits

The best time to do a Cost Segregation Study is the first year the property is placed in service. However, you have the ability to perform a study retroactively and receive tax benefits.

Benefits:

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.