New York Sales Tax Returns

Sales tax is tax placed by the government on the sale of goods and services.

As a business owner, you want to make sure you are collecting the correct amount of sales tax from your customers.

If you’re registered for sales tax purposes in New York State, you must file sales and use tax returns monthly, quarterly, or annually with the state. Even if your business did not make any taxable sales or purchases during the period, you must file your sales and use tax by the due date.

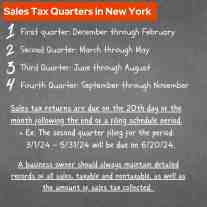

Sales Tax Quarters in New York

Sales tax returns are due on the 20th day of the month following the end of a filing schedule period.

A business owner should always maintain detailed records of all sales, taxable and nontaxable, as well as the amount of sales tax collected.

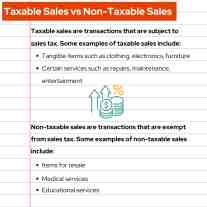

Taxable Sales vs Non-Taxable Sales

Taxable sales are transactions that are subject to sales tax. Some examples of taxable sales include:

Non-taxable sales are transactions that are exempt from sales tax. Some examples of non-taxable sales include:

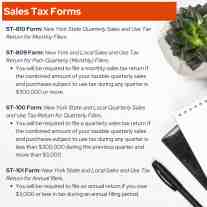

Sales Tax Forms

ST-810 Form: New York State Quarterly Sales and Use Tax Return for Monthly Filers

ST-809 Form: New York and Local Sales and Use Tax Return for Part-Quarterly (Monthly) Filers.

ST-100 Form: New York State and Local Quarterly Sales and Use Tax Return for Quarterly Filers.

ST-101 Form: New York State and Local Sales and Use Tax Return for Annual filers.

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.