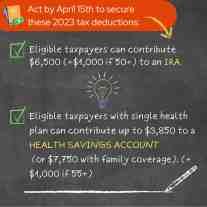

Act by April 15th to secure these 2023 tax deductions:

- Eligible taxpayers can contribute $6,500 (+$1,000 if 50+) to an IRA.

- Eligible taxpayers with single health plan can contribute up to $3,850 to a HEALTH SAVINGS ACCOUNT (or $7,750 with family coverage). (+$1,000 if 55+)

Organize and gather your tax documents to ensure maximum tax deduction:

- If self-employed, compile and thorough records of deductions like home office and travel expenses;

- Gather documentation for any purchase that qualify for energy efficient tax credits (e.g., Insulation, doors, windows and appliances) or EV tax credits;

- Organize all of your earnings statements (e.g., 1099s, W-2s, K-1s) and use a scanner or a mobile app like Adobe Scan to create high quality electronic copies, your accountant will thank you!

- For new rental properties, gather your closing statement, invoices for any significant improvements, appliances, etc. to maximize depreciation deductions!

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.