Thinking About Buying a New Car? Consider an EV! EVs provide a great year-end tax planning opportunity.

The credit is available for both individuals and their businesses.

To qualify, you must:

Additionally, your AGI may not exceed:

Qualified Vehicles:

To qualify, a vehicle must:

The sale qualifies only if:

In addition, the vehicle's MSRP can't exceed:

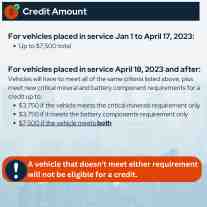

Credit Amount:

For vehicles placed in service Jan 1 to April 17, 2023:

For vehicles placed in service April 18, 2023 and after:

Vehicles will have to meet all of the same criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:

A vehicle that doesn't meet either requirement, will not be eligible for a credit.

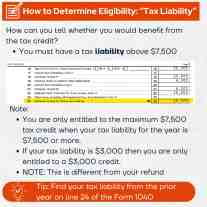

How to Determine Eligibility: “Tax Liability”

How can you tell whether you would benefit from the tax credit?

Note:

Tip: Find your tax liability from the prior year on line 24 of the Form 1040

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.