1099 Reporting Requirements

The IRS focuses heavily on taxpayer compliance with information reporting laws. Penalties for noncompliance have steadily increased over the years.

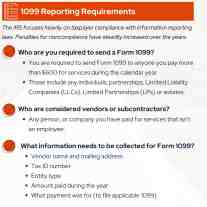

Who are you required to send a Form 1099?

Who are considered vendors or subcontractors?

What information needs to be collected for Form 1099?

Exceptions

Are there exceptions to who gets a 1099?

The list is lengthy. The most common exceptions are:

The IRS allows taxpayers to exclude from filing Form 1099 any payments reported by the credit card issuers and third-party payment networks on Form 1099-K.

Tips & Best Practices

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.