New DOL Rule & Misclassification:

The U.S. Department of Labor (DOL) has issued a new rule that offers guidance for employers to determine whether to classify a worker as an employee or independent contractor under the Fair Labor Standards Act (FLSA).

Incorrect worker classification can:

Effective March 11th, 2024, the rule voids the 2021 Independent Contractor Rule that, according to the news release, the DOL "believes is not consistent with the law and longstanding judicial precedent."

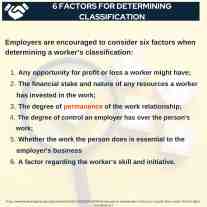

6 Factors for Determining Classification:

Employers are encouraged to consider six factors when determining a worker‘s classification:

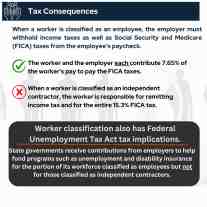

Tax Consequences:

When a worker is classified as an employee, the employer must withhold income taxes as well as Social Security and Medicare (FICA) taxes from the employee's paycheck.

Worker classification also has Federal Unemployment Tax Act tax implications.

State governments receive contributions from employers to help fund programs such as unemployment and disability insurance for the portion of its workforce classified as employees but not for those classified as independent contractors.

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.