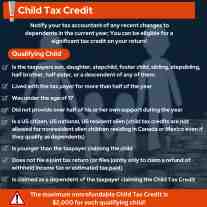

Child Tax Credit

Notify your tax accountant of any recent changes to dependents in the current year; You can be eligible for a significant tax credit on your return!

Qualifying Child

- Is the taxpayers son, daughter, stepchild, foster child, sibling, stepsibling, half brother, half sister, or a descendent of any of them.

- Lived with the tax payer for more than half of the year

- Was under the age of 17

- Did not provide over half of his or her own support during the year

- Is a US citizen, US national, US resident alien (child tax credits are not allowed for nonresident alien children residing in Canada or Mexico even if they qualify as dependents)

- Is younger than the taxpayer claiming the child

- Does not file a joint tax return (or files jointly only to claim a refund of withheld income tax or estimated tax paid), and

- Is claimed as a dependent of the taxpayer claiming the Child Tax Credit

The maximum nonrefundable Child Tax Credit is $2,000 for each qualifying child!

Credit for Other Dependents

- A $500 nonrefundable credit is available for dependents who are not qualifying children for the Child Tax Credit and each qualifying relative.

AGI Phaseout

- The Child Tax Credit is reduced $50 for each $1,000 of modified AGI:

- $400,000 for Married Filing Jointly

- $200,000 for all other filing statuses

If you're a taxpayer in the New York Metro Area and need help making the best decisions for tax return, request a consultation with our experienced accountants today. We look forward to providing you service.