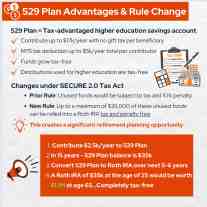

529 Plan Advantages & Rule Change

529 Plan = Tax-advantaged higher education savings account

Changes under SECURE 2.0 Tax Act

1. Contribute $2.5k/yr to 529 Plan

2. In 15 years - 529 Plan balance is $35k

3. Start converting 529 Plan to Roth IRA over the next 5-6 years

4. A Roth IRA of $35k at the age of 25 would be worth $1.1M at the age of 65... Completely tax-free

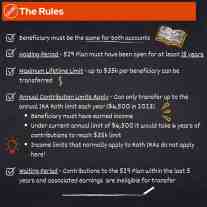

The Rules

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.