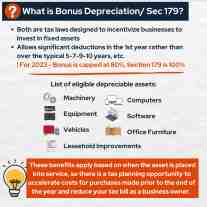

What is Bonus Depreciation/ Sec 179?

List of eligible depreciable assets:

These benefits apply based on when the asset is placed into service, so there is a tax planning opportunity to accelerate costs for purchases made prior to the end of the year and reduce your tax bill as a business owner.

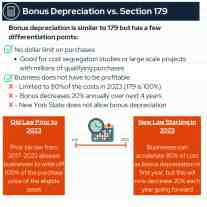

Bonus depreciation is similar to 179 but has a few differentiation points:

No dollar limit on purchases

Business does not have to be profitable

X - Limited to 80%of the costs in 2023 (179 is 100%)

X – Bonus decreases 20% annually over next 4 years

X - New York State does not allow bonus depreciation

Old Law Prior to 2023

Prior tax law from 2017-2022 allowed businesses to write off 100% of the purchase price of the eligible asset

New Law Starting in 2023

Businesses can accelerate 80% of cost as bonus depreciation in first year, but this will now decrease 20% each year going forward

Bonus Depreciation Phase Out Schedule

Tip: If your company is planning to make a big purchase in the beginning of 2024, it may be to your advantage instead to purchase in 2023 to be able to write off 80% rather than 60%

2023 Limitations

When to Use 179:

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.