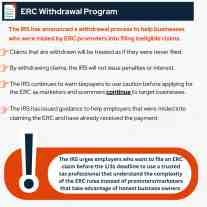

ERC Withdrawal Program

The IRS has announced a withdrawal process to help businesses who were misled by ERC promoters into filing ineligible claims.

The IRS urges employers who want to file an ERC claim before the 1/31 deadline to use a trusted tax professional that understand the complexity of the ERC rules instead of promoters/marketers that take advantage of honest business owners.

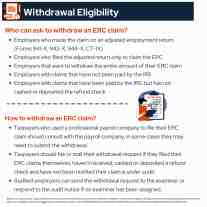

Withdrawal Eligibility

Who can ask to withdraw an ERC claim?

How to withdraw an ERC claim?

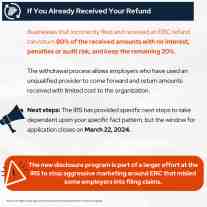

Businesses that incorrectly filed and received an ERC refund can return 80% of the received amounts with no interest, penalties or audit risk, and keep the remaining 20%.

The withdrawal process allows employers who have used an unqualified provider to come forward and return amounts received with limited cost to the organization.

Next steps: The IRS has provided specific next steps to take dependent upon your specific fact pattern, but the window for application closes on March 22, 2024.

The new disclosure program is part of a larger effort at the IRS to stop aggressive marketing around ERC that misled some employers into filing claims.

If you're a business owner in the New York Metro Area and need help making the best decisions for your business, request a consultation with our experienced accountants today. We look forward to providing you service.