Avoiding Penalties on Early Retirement Withdrawals

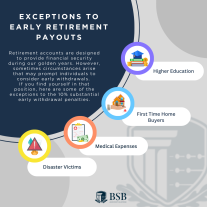

Retirement accounts are designed to provide financial security during our golden years. However, life is unpredictable, and sometimes circumstances arise that may prompt individuals to consider early withdrawals from their retirement funds. Early withdrawals should generally be a last resort, as they can have long-term repercussions on your retirement savings and tax penalties, however there are certain situations where it may make sense to tap into these funds before reaching the traditional retirement age.

With home prices on Long Island skyrocketing, homebuyers are under more pressure than ever to come up with the cash to afford a sufficient downpayment (e.g., to avoid PMI or to bring interest rate down) or to compete with all-cash offers. Depending on your financial situation, your retirement funds could provide that additional last bit of funding to help secure a home.

Whether you find yourself in this position, or trying to afford higher education costs, or dealing with a disaster, here are some of the “hardship withdrawal” exceptions to the 10% substantial early withdrawal penalties.

First Time Homebuyers - Early payouts from IRAs to help "first-time" home buyers are penalty free. IRA owners who didn't own a home in the prior two years can take out up to $10,000 to buy or build a main home or one for a spouse, kid, grandkid, parent or grandparent.

Alternatively – your company’s 401(k) plan may offer a program to borrow money from your 401(k) which you can use towards a purchase of principal residence without incurring any tax or penalties, a better option if available. You will have to repay that loan over time with interest, effectively paying yourself.

Higher Education - Early payout from IRAs to assist with the cost of higher education are penalty free. This includes college tuition, computers, books, and room and board for students enrolled at least half time. There is no dollar cap. To qualify for the exception, the early distribution must cover education costs.

Disaster Victims - Early withdrawals from IRAs and 401(k)s by qualified disaster victims are penalty free up to $22,000 per disaster. Payouts must generally be taken within 179 days of the date the disaster is declared. The distribution is taxable, but you can choose to spread the income from the qualified distribution over a three-year period beginning with the year of distribution, rather than paying all of the tax in the distribution year.

Medical Expenses - IRAs and 401(k)s can be utilized to pay large medical expenses without penalty. The money must be used for medical costs of the taxpayer, spouse or dependent and the funds must cover costs paid in the year of the withdrawal. Medical expenses only qualify for the hardship withdrawal exception to the extent they exceed 7.5% of the plan holder’s Adjusted Gross Income (AGI).

If you are looking for individual tax services tailored to your personal situation, request a consultation with our experienced accountants today. We look forward to helping you build a strong financial foundation!